I received a letter (from the insurance company) indicating they made an overpayment on an account. How do I post the overpayment?

1. Go to Accounts Receivable>Pay/Adj Codes. Create a payment code, i.e. 099 – Overpayment and Save

(If you already have such a code set up, use that code and proceed to Step 2. For more information on how to set up a payment/adjustment code, click here.)

2. Go to Accounts Receivable>Post Payments>Post Paper/RA

3. Click on the final entry - of the month that needs to be adjusted. The Add/Edit Accounts Receivable Posting screen will appear.

4. Enter the appropriate date, such as the date you received the Overpayment Letter, or date of letter.

5. Enter the overpayment amount with a minus sign, and the appropriate code. You also have the option to enter any Comments.

6. Continue with normal procedure to Post Paper RA

I received confirmation (from our accounting dept; or the next RA received from the insurance company) indicating the overpayment has been sent back to the payer. How do I post the payback/refund?

7. Go to Accounts Receivable>Post Payments>Post Paper/RA

8. Click on the final entry - of the month that needs to be adjusted. The Add/Edit Accounts Receivable Posting Entry Screen will appear.

9. If there is not a pay/adj code set up for Refunds, set up one. An option would be "Refunded To Payer." See Step 1 on how to set up a payment/adjustment code.

10. Enter the date the payment was refunded, such as date of the refund check; or the date of the RA where the payment was reversed.

11. Enter the payment amount with a (-) in front of the dollar amount. Enter any Comments.

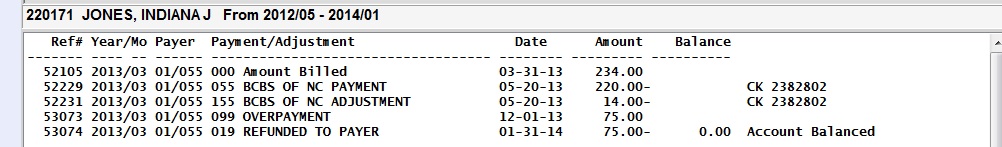

12. Continue with normal procedure to Post Paper RA. Once you are done, the screen will look like this: